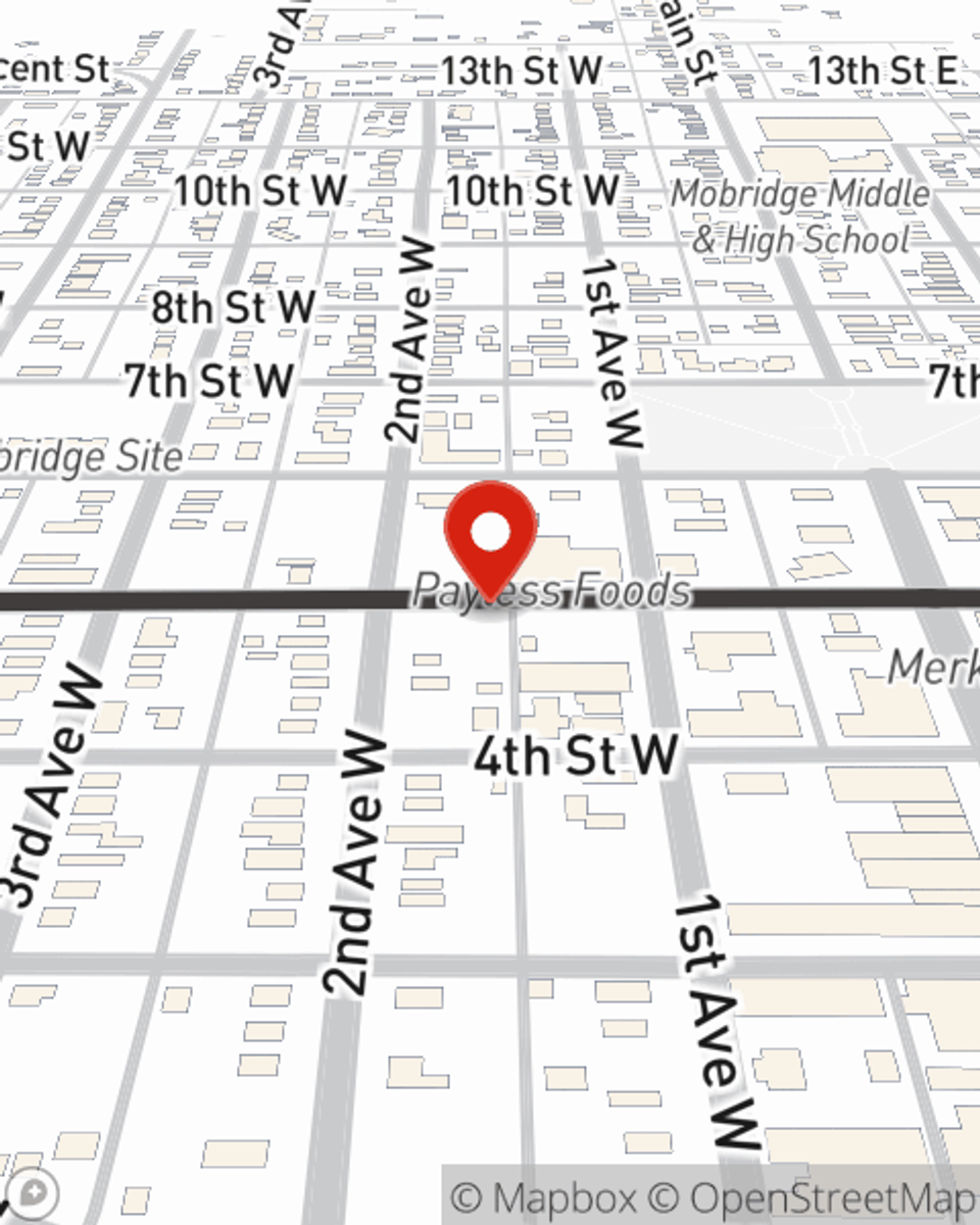

Business Insurance in and around Mobridge

Looking for small business insurance coverage?

Cover all the bases for your small business

Business Insurance At A Great Value!

Small business owners like you have a lot on your plate. From product developer to HR supervisor, you do as much as possible each day to make your business a success. Are you a psychologist, a piano tuner or a drywall installer? Do you own an antique store, a donut shop or a candy store? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Cover all the bases for your small business

Cover Your Business Assets

Every small business is unique and faces a wide array of challenges. Whether you are growing an acting school or a pet store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Doug Heil can help with errors and omissions liability as well as commercial auto insurance.

As a small business owner as well, agent Doug Heil understands that there is a lot on your plate. Reach out to Doug Heil today to learn about your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Doug Heil

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.